Top Mortgage Broker Glendale CA: Professional Assistance for Your Desire Home

Top Mortgage Broker Glendale CA: Professional Assistance for Your Desire Home

Blog Article

Discovering Why Partnering With a Mortgage Broker Can Dramatically Simplify Your Home Acquiring Experience

Navigating the intricacies of the home purchasing procedure can be challenging, yet partnering with a home mortgage broker provides a critical advantage that can enhance this experience. By acting as intermediaries in between you and a wide variety of lending institutions, brokers offer accessibility to customized car loan alternatives and expert insights that can minimize potential challenges. Their effectiveness not just enhances effectiveness yet additionally fosters a much more tailored approach to securing positive terms. As we discover the numerous facets of this partnership, one may question exactly how these advantages show up in real-world scenarios and impact your total trip.

Recognizing Home Loan Brokers

These specialists possess extensive expertise of the home mortgage industry and its policies, permitting them to browse the complexities of the financing process effectively. They aid borrowers in gathering required paperwork, finishing financing applications, and ensuring that all demands are satisfied for a smooth authorization procedure. By bargaining terms in behalf of the debtor, mortgage brokers often work to protect beneficial rate of interest and conditions.

Inevitably, the expertise and resources of mortgage brokers can considerably simplify the home purchasing experience, minimizing a few of the problems normally linked with safeguarding funding. Their function is important in assisting customers make notified decisions tailored to their monetary goals and unique conditions.

Advantages of Utilizing a Broker

Using a mortgage broker can supply countless benefits for homebuyers and those looking to re-finance. One considerable benefit is access to a broader variety of finance choices. Unlike banks that might only present their very own products, brokers function with several lenders, making it possible for customers to explore numerous home loan solutions customized to their particular economic circumstances.

Additionally, home loan brokers possess comprehensive market understanding and competence. They remain notified regarding market patterns, rates of interest, and lender requirements, ensuring their customers obtain timely and accurate information. This can lead to more favorable lending terms and potentially reduced passion rates.

Furthermore, brokers can aid recognize and attend to prospective obstacles early in the mortgage procedure. Their experience enables them to visualize challenges that might develop, such as credit score problems or paperwork requirements, which can conserve clients time and stress.

Last but not least, dealing with a mortgage broker often brings about individualized service. Brokers commonly spend time in understanding their customers' distinct needs, leading to a more tailored method to the home-buying experience. This mix of gain access to, proficiency, and tailored service makes partnering with a home mortgage broker a vital asset for any kind of homebuyer or refinancer.

Streamlined Application Refine

The procedure of obtaining a home mortgage can typically be frustrating, however partnering with a broker dramatically simplifies it (Mortgage Broker Glendale CA). A home mortgage broker acts as an intermediary between the consumer and the loan provider, enhancing the application procedure through professional guidance and organization. They start by analyzing your financial circumstance, accumulating necessary papers, and recognizing your specific requirements, making certain that the application is customized to your situations

Brokers are skilled in the details of home mortgage applications, helping you prevent typical challenges. They provide clarity on needed paperwork, such as earnings confirmation, credit reports, and asset statements, making it much easier for you to collect and send these products. With their considerable experience, brokers can prepare for possible obstacles and resolve them proactively, reducing disappointments and delays.

Access to Several Lenders

Accessibility to a diverse selection of lenders is among the key advantages of partnering with a home mortgage broker. Unlike traditional home getting approaches, where buyers are usually limited to one or two lending institutions, mortgage brokers have developed partnerships with a vast array of banks. This substantial network permits brokers to existing clients with multiple finance alternatives tailored to their financial situations and distinct requirements.

By having accessibility to numerous lending institutions, brokers can quickly identify competitive rate of interest prices and positive terms that might not be readily available via straight networks. This not just boosts the possibility for securing discover this info here a more advantageous mortgage however also broadens the scope of available products, including specialized car loans for novice buyers, veterans, or those seeking to purchase buildings.

In addition, this accessibility conserves effort and time for property buyers. As opposed to getting in touch with multiple lenders independently, a home mortgage broker can enhance the process by gathering necessary documents and sending applications to a number of lending institutions all at once. This effectiveness can result in quicker approval times and a smoother total experience, enabling purchasers to focus on discovering their optimal home rather than browsing the intricacies of mortgage alternatives alone.

Customized Assistance and Assistance

Navigating the mortgage landscape can be frustrating, but partnering with a home mortgage broker supplies customized guidance and assistance tailored to every client's details requirements. Home mortgage brokers function as intermediaries, comprehending individual economic situations, choices, and long-term objectives. This personalized strategy guarantees have a peek at this site that customers receive recommendations and services that straighten with their unique conditions.

A competent home mortgage broker conducts detailed assessments to determine the very best financing alternatives, considering aspects such as credit history, revenue, and debt-to-income ratios. They likewise inform customers on various home loan items, aiding them comprehend the ramifications of various passion rates, charges, and terms. This knowledge equips clients to make educated choices.

In addition, a mortgage broker provides continuous assistance throughout the whole home acquiring procedure. From pre-approval to closing, they promote communication between clients and lenders, dealing with any check these guys out type of worries that might develop. This continual assistance relieves stress and anxiety and conserves time, permitting customers to concentrate on locating their desire home.

Verdict

To conclude, partnering with a home loan broker uses many benefits that can substantially improve the home purchasing experience. By providing accessibility to a wide array of funding options, facilitating a streamlined application process, and supplying expert assistance, brokers efficiently reduce challenges and lower stress and anxiety for buyers. This expert support not just enhances effectiveness but additionally boosts the probability of securing favorable financing terms, inevitably contributing to a more effective and rewarding home purchasing trip.

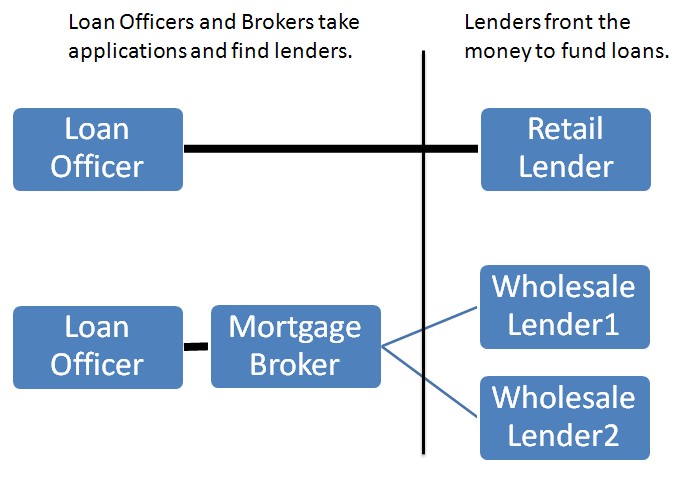

Navigating the complexities of the home getting process can be daunting, yet partnering with a home mortgage broker provides a strategic benefit that can streamline this experience.Home mortgage brokers serve as middlemans between borrowers and loan providers, helping with the financing process for those looking for to purchase a home or re-finance an existing home loan. By streamlining the application, a home loan broker boosts your home purchasing experience, permitting you to focus on discovering your desire home.

Unlike conventional home acquiring methods, where purchasers are often limited to one or 2 lending institutions, home loan brokers have actually developed relationships with a large array of financial organizations - Mortgage Broker Glendale CA.Browsing the home mortgage landscape can be overwhelming, however partnering with a home mortgage broker gives customized support and assistance customized to each client's particular requirements

Report this page